IPmt

The IPmt function returns the interest portion of a periodic, constant payment for an investment or loan with a constant interest rate.

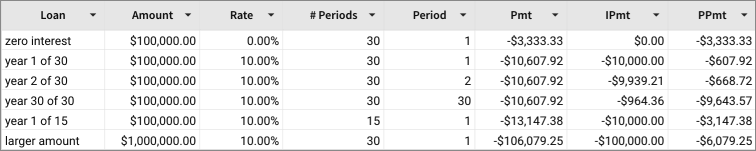

To determine the total payment, or how much is allocated to principal, use the Pmt and PPmt functions.

Syntax

IPmt(rate, period, nperiods, pv, [fv], [type])The IPmt function has the following arguments:

rate

(required) The interest rate for the loan.

period

Current payment period.The valid range is 1 through nperiods.

nperiods

The total number of payments for the loan.

pv

Required. The present value, or total value of all loan payments; the amount borrowed.

fv

(Optional) The future value, or a cash balance you want after the last payment is made. Defaults to 0 (zero).

type

(Optional) When payments are due: 0 End of period 1 Beginning of period Default is 0.

Notes

Be consistent with the units for rate and nperiods arguments. If you make monthly payments on a two-year loan at an annual interest rate of 7%, use the rate calculation of 0.07/12 and nperiods calculation of 2*12. For annual payments on the same loan, use the rate of 0.07 and nperiods of 2.

Examples

IPmt(.07/12,1,2*12,10000)

IPmt(.07/12,2*12,2*12,10000)The first monthly interest payment for a loan of $10,000, with an annual interest rate of 7% is $58.33. The last (24th) interest payment is $2.60.

The first year's interest payment for a two-year loan of $10,000, with an annual interest rate of 7% is $700.00. The last payment (second year) has the interest payment of $361.84.

The first yearly payment for a loan of $100,000, with an annual interest rate of 10% over 30 years, compounded yearly, has the interest payment of $10,000.00. The last payment (year 30) has the interest payment of $964.36.

Last updated

Was this helpful?